Gold prices are rising, should investors increase their investments in 2023?

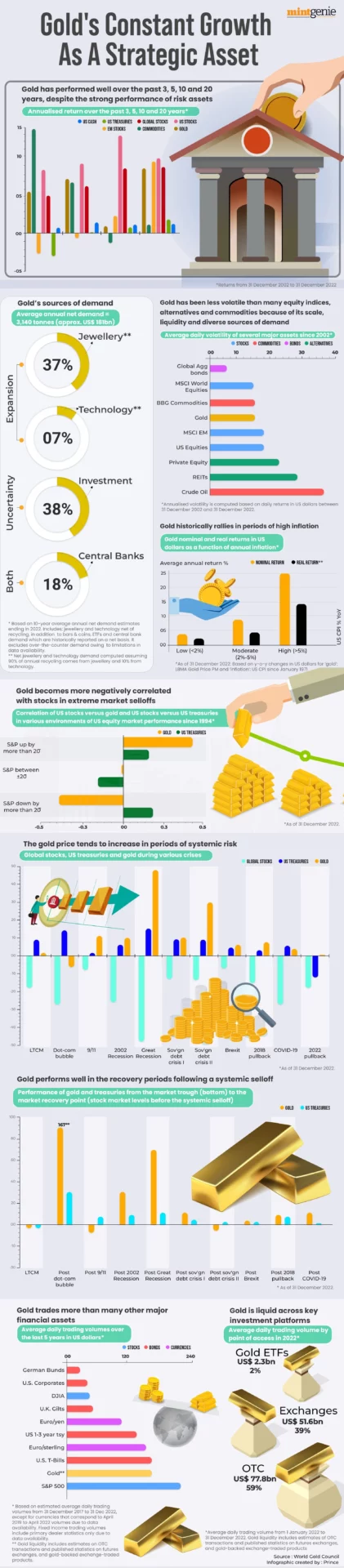

An assessment of the returns on SGBs reveals how SGB investors have earned more than 13 per cent returns in the past eight years. The appreciation in gold prices is attributed to economic uncertainty, first due to the pandemic and then due to ongoing geopolitical tensions.

The lure of gold has enchanted even the country’s central bank as the Reserve Bank of India (RBI) is on a gold-buying spree for many months. In March this year, the RBI bought 10 tonnes of gold. The central bank shared its intent to diversify and expand its reserves amid global tensions resulting in fear of inflation and constant devaluation of the currency.

Should you buy gold now?

With gold prices going up, many investors have inquired if they must now focus on gold investments instead of equities. Add to this the market volatility that is now prompting many people to rejig their investments in favour of gold bonds, bullions, ETFs, and more.

A tête-à-tête with some personal financial experts revealed their outlook toward gold investments and to what extent one must allocate their earnings to gold investments for better returns.

Basavaraj Tonagatti, a certified financial planner and SEBI-registered investment advisor said, “Rather than increasing your gold exposure just because of the rise in the gold price, I strongly advise you to first review your portfolio’s asset allocation of stock, debt, and gold. Based on it, you must decide whether to expose to gold or not. Also, keep in mind that gold has the almost same volatility as equity. Hence, even if there is a negative correlation between stock and gold, increase your exposure to gold only if you can stomach gold’s volatility.”

The age-old adage “Be fearful when others are greedy” applies to gold as much to stocks. Buying gold when its price is rising may not help. The trick is to wait for the prices to cool down and then allocate your earnings to it depending on how much importance you lend to gold investments.

D Muthukrishnan, a Chennai-based certified financial planner, explained, “It’s not wise to increase allocation when the price of an asset is going up. One can allocate 10 per cent of wealth towards gold. When prices go up, he may do nothing. When prices go down and hence the allocation falls below 10 per cent, that is the time to increase the allocation and bring it back to 10 per cent.”

“For Indian investors, gold has provided a good macro and currency hedge and it should be used as such. A 15-25 per cent allocation to gold based on risk preferences helps diversify away from tail risk. However, there is no evidence that momentum investing, i.e., buying gold when the price is rising helps investors get better outcomes in terms of gold pricing,” shared Gaurav Rastogi, founder and CEO, Kuvera.in.

Neil Bahal, Founder & CEO, Negen Capital does not seem too excited about putting money in gold. Bahal elucidated, “Gold doesn’t produce anything. It is only an inflation hedge. Unlike stocks or bonds, gold does not generate income or earnings. When you invest in stocks, you are investing in companies that produce goods or services, generating profits and potentially paying dividends. So, investors who want protection against inflation can buy gold in India. For me personally, I would prefer to invest in producing assets in a diversified manner.

Many investors are getting excited in India about gold investments. A certain amount of gold investment can help alleviate the inherent volatility in the stock market. However, how much gold you must buy and in what form depend on how much returns you are expecting from investing in it apart from its tax benefits.