Special Situation Case Study – Max India

- Max India used to suffer from significant corporate governance discount due to its promoter’s sketchy reputation.

- It also suffered from ‘Holding Company’ Discount due to multiple non essential and loss making businesses inside.

- Along came KKR & Mr.Soi and proposed a new structure which did the following: 1- Merged Max Health & Radiant Health. 2- Demerged the rest of the loss making businesses into a separately listed company

What This Merger & Demerger Did For Max Health Was Incredible.

- Pre-Merger/Demerger.

- Holding company structure.

- Corporate governance overhang.

- Regional player with no focus.

- Average to poor company overall.

- Post Merger/Demerger.

- Holding company became a pure operating company.

- Old promoter went out and MNC promoter came in with a firm view to grow the business.

- Merger with Radiant catapulted Max Health to being India’s second largest Hospital network.

- Incentive led ownership structure handed out to upper management created skin in the game.

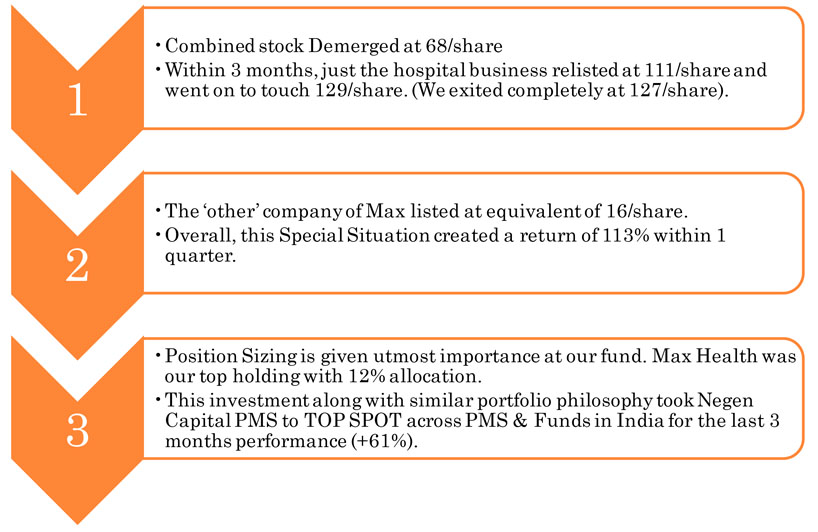

Max Health Post Listing Result And Impact On NEGEN CAPITAL PMS